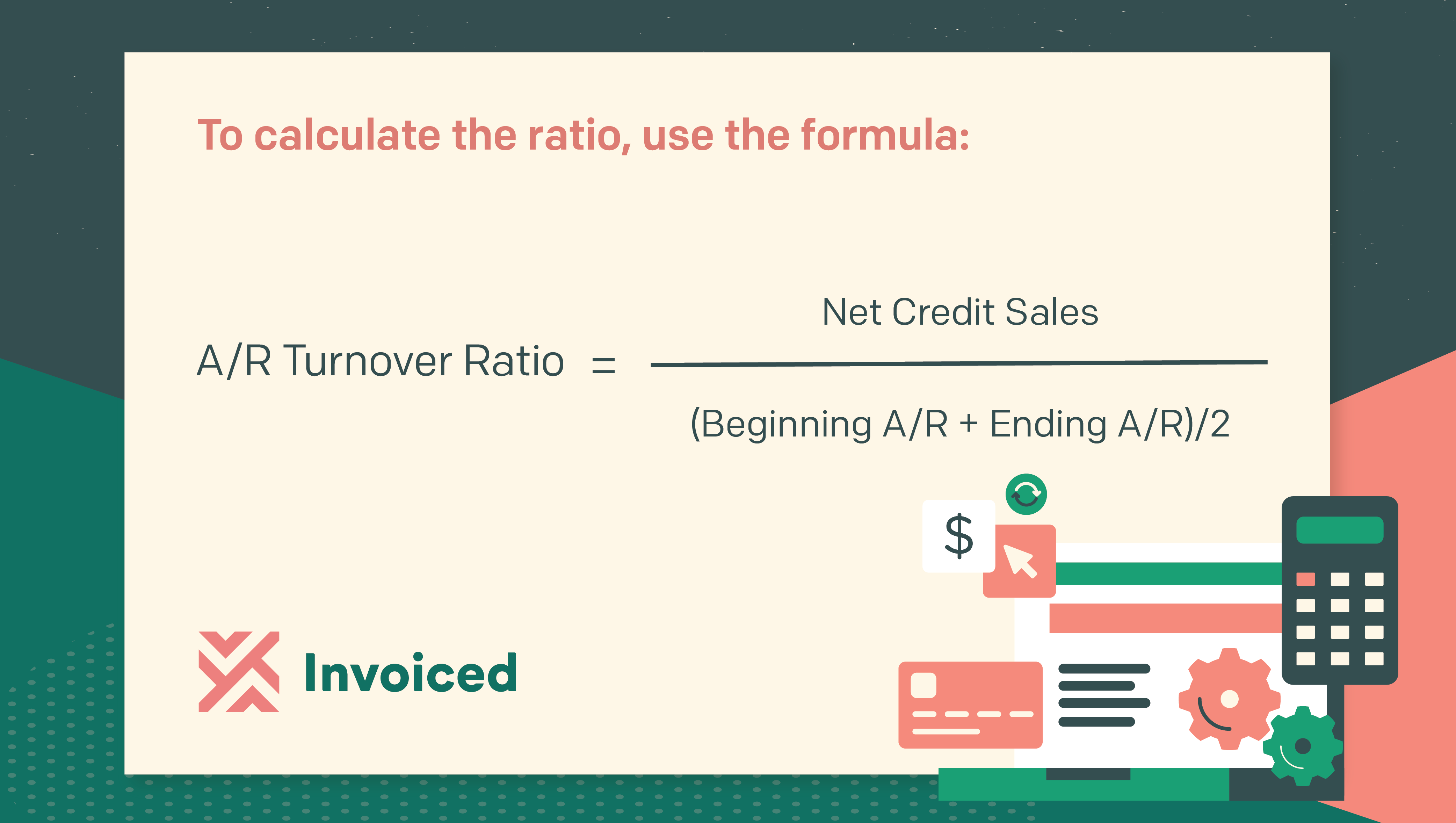

A ratio below six indicates that a business is not generating enough revenue to pay its suppliers in an appropriate time frame. Bear in mind, that industries operate differently, and therefore they’ll have different overall AP turnover ratios. The accounts receivable turnover ratio is an accounting measure used to quantify a company’s effectiveness in collecting its receivables, or the money owed to it by its customers.

What is a Good Accounts Payable Turnover Ratio in Days (DPO)?

Compare your ratio with the industry average to get a better idea of where you stand. Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations. The “Supplier Credit Purchases” refers to the total amount spent ordering from suppliers. Our partners cannot pay us to guarantee favorable reviews of their products or services.

Payables Turnover Ratio Formula

On the other hand, a low AP turnover ratio can raise concerns about a company’s financial management. It may signal cash flow problems, indicating that the company is not efficiently settling its payables. Additionally, a low ratio might suggest that the company is missing out on early payment discounts, which could lead to higher operational costs.

Common Challenges in Maintaining a Good Accounts Payable Turnover Ratio

- Using automation businesses can easily track payment due dates, and optimize payment schedules for timely payments.

- Vendors can check their payment status through the self-service portal freeing up the finance team to concentrate on other critical tasks.

- Improved cash flow management inherently affects the AP turnover ratio by ensuring funds are available for timely payments.

- Some companies will only include the purchases that impact cost of goods sold (COGS) in their Total Purchases calculation, while others will include cash and credit card purchases.

- Accounts payable turnover ratio is a helpful accounting metric for gaining insight into a company’s finances.

A high Accounts Payable Turnover Ratio can help them maintain good relationships with their suppliers and ensure a steady supply of materials. This can help them meet production deadlines and improve their overall efficiency. Another industry that can benefit from a high Accounts Payable Turnover Ratio is the healthcare industry. Healthcare providers need to purchase a large volume of medical supplies and equipment, and they need to pay their suppliers on time to ensure a steady supply of essential items. A high Accounts Payable Turnover Ratio can help healthcare providers negotiate better prices and payment terms with their suppliers, which can ultimately lead to cost savings for patients. Below we cover how to calculate and use the AP turnover ratio to better your company’s finances.

Example of AP Turnover Ratio

AI-driven insights offer valuable information for businesses to forecast and come up with strategic financial plans. Cflow enables automated audits with synchronized invoice data from supplier details to payment throughout the payment cycle. With real-time tracking and automated notifications, AP automation systems can process invoices quickly.

Bargaining power also has a significant role to play in accounts payable turnover ratios. For example, larger companies can negotiate more favourable payment plans with longer terms or higher lines of credit. While this will result in a lower accounts payable turnover ratio, it is not necessarily evidence of shaky finances.

Industries that rely on a high volume of purchases and frequent payments to their suppliers can benefit significantly from a high Accounts Payable Turnover Ratio. A high Accounts Payable Turnover Ratio can help them maintain good relationships with their suppliers and obtain better terms, discounts, and payment flexibility. By renegotiating payment terms with your vendors, you can improve the length of time you have to pay, and can improve relationships by paying on time.

Since the bank reconciliation adjustments in xero ratio indicates how quickly a company pays off its vendors, it is used by supplies and creditors to help decide whether or not to grant credit to a business. As with most liquidity ratios, a higher ratio is almost always more favorable than a lower ratio. So, while the accounts receivable turnover ratio shows how quickly a company gets paid by its customers, the accounts payable turnover ratio shows how quickly the company pays its suppliers. The accounts payable turnover ratio is a metric that is used to measure the rate at which a business is able to send out payments to suppliers and creditors that extend lines of credit. Like other accounting ratios, the accounts payable turnover ratio provides useful data for financial analysis, provided that it’s used properly and in conjunction with other important metrics. It’s used to show how quickly a company pays its suppliers during a given accounting period.

It goes without saying that managing cash flow is an important part of business management. Auditing how you manage your cash flow can help you identify the impact reducing days payable outstanding might have. On the other hand, an account payable turnover ratio that is decreasing could mean that your payment of bills has been slower than in previous periods. If the AP turnover ratio is 7 instead of 5.8 from our example, then DPO drops from 63 to 52 days.